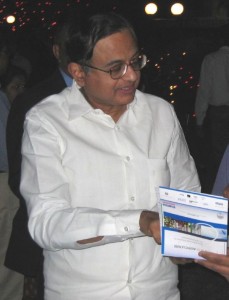

The Indian rupee has fallen down to the lowest so far, which has added to the woes of the Indian economy. To add to the anguish, India’s love for gold is making the situation even more difficult. The obsession with gold has been proved time and again with instances like Tata Motors gilding up Tata Nano in 80 kg of gold in 2011, Datta Phuge, a businessman based in Pune spending $250,000 to make a shirt made of pure gold. So when P. Chidambaram, the Finance Minister of India insisted on stopping the purchase of gold, it came as a shocker for many.

But the main reason behind such a plea is the huge amount of money that is spent in the import of gold every year. Over the last 12 months, the rupee has lost 9 percent of its value against the dollar. This has led to more pressure on the existing account deficit of the country. So instead of importing gold, the country should spend their money on importing vital things like machinery, edible oil, gas, et al. The foreign exchange should be saved in order to fulfill the essential requirements of the country.

The reports from the World Gold Council depict another scene. The import of gold has increased over the past years. In 2000- 01, India imported 471 tons of gold, whereas in 2013, the total import of this yellow metal was way higher at 1017 tons. Indians are so much in love with gold and as it has become a part of the society since a long time, it is almost impossible to stop the purchase of gold. Also, majority of the people are not aware of the fact that this metal has to be imported from countries like UAE and Switzerland, rather than locally sourced. Once the people get to know about this fact, it can be hoped that the demand will come down.

Chidambaram has not banned the import of gold completely. Instead, he has raised the import duty from 2% to 8% from the beginning of 2012. This has started showing effective results as well. The demand for gold has decreased from 162 tons in May to 41 tons in June.

However, this cannot be deemed as the ultimate solution as Indians consider gold as a saving with 10% household investing in gold. In order to bring down the love for gold, new opportunities can be created for safer financial investments and steps should be taken to enlarge the banking system.