The communist parties have urged the UPA government to restrict the foreign fund inflows into Indian stock market. The left leaders have said that the government should restrict the foreign investors buying shares in Indian capital market. To restrict the inflow of foreign funds, that may hurt Indian economy, the use of Participatory notes should be avoided.

Earlier on Tuesday, the Securities and Exchange Board of India (SEBI) had proposed to restrict the inflow of funds into share market through ‘Participatory Notes’. Through the P-notes, the unregistered investors gain exposure to Indian stock market.

The CPM politburo said:

The party is of the firm opinion that P-notes should be prohibited as has been recommended by the RBI.

CPM MP Nilotpal Basu said that the foreign money is being pumped in the share market through participatory notes. This is faceless money. It could be money brought in to rig stocks at best. At worst it is graft or other illegal funds being legitimised. The global hedge funds and overseas investors use the P-notes as derivative instruments in order to conceal their identities while investing funds in stock market.

Some market analysts say that the P-notes are actually the way to bring illegal funds in share market. They even say that the use of P-notes should be banned in the Indian share market.

The SEBI, the watchdog of Indian share market, has proposed to restrict the P-notes inflow in Indian stock market. At the same time, the center government has tried to moderate the fears of Foreign Institutional Investors (FIIs) over the proposed restriction on the P-notes by the SEBI.

Later, the CPM has condemned the finance ministry for avoiding the SEBI’s proposals and RBI’s recommendation to phase out the P-notes from Indian share market. After successfully freezing the historical Indo-US civilian nuclear deal, the left parties have eyed on the recent volatility in the stock market.

Basu said:

The Communist Party of India (Marxist) is of the firm opinion that participatory notes should be prohibited, as has been recommended by the Reserve Bank of India.

According to data, as much as $10 billion of current year’s inflow may have come through the P-notes in the market. The inflows have also strengthened the value of Indian currency against the US dollar to its highest in 9-1/2 years.

Participatory Notes

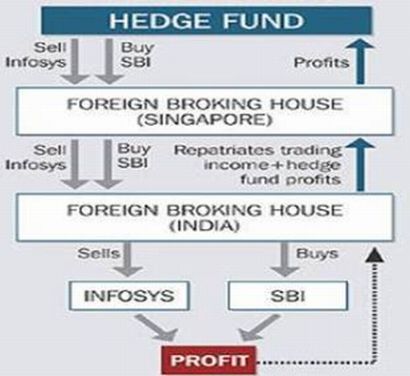

The international access to the Indian stock market is limited to Foreign Institution Investments so international market created the cash instrument named as ‘Participatory notes’. The P-notes account for half the $80 billion that stands to the credit of FIIs and makes the investment very simple and popular.

The registered Foreign Institutional Investors issue the P-notes to overseas investors who wish to invest funds in the Indian stock markets. The use of P-notes helps them to invest the funds in Indian capital market without registering themselves with the SEBI, the Securities and Exchange Board of India.

P-Notes are issued to the real investors on the basis of stocks purchased by the Foreign Institutional Investors. The registered investor looks after all the transactions as the proprietor in the trade books. This is not mandatory for the investors to disclose their client details to the market watchdog SEBI, unless asked distinctively to disclose the detail.